Investment Products Options Trading

Products

Powerful Tools for Advanced Options Trading Worldwide

The IBKR Advantage

- Commissions from USD 0.15 to 0.65 per US option contract

- Trade options globally on 30+ market centers

- Professional trading platforms and advanced options trading tools

- Choose from four levels of options trading permissions to find choices more precisely aligned with your options trading strategies.

- Options trading education available at IBKR Traders' Academy features strategies, tips and tools for success for beginner to advanced investors

US Stock Option Trading Costs for UK Residents

The comparison to other providers is based on the rates published on their websites as of August 23, 2024 for deals in US stock options. Providers' account types used for this illustration are what we consider default standard tier.1

See Notes and Disclaimers for complete information.

| Total Trade Cost2 | Advertised Rates3 | |||

|---|---|---|---|---|

| Broker | 1 contract at USD 5.00 |

5 contracts at USD 8.00 |

US Stock Option Commission per Contract |

FX Conversion Fee |

| Interactive Brokers4 | £0.87 | £3.37 | USD 0.65 | 0.03% |

| Degiro5 | £1.52 | £10.42 | USD 0.75 | 0.25% |

| Saxo6 | £1.52 | £10.42 | USD 0.75 | 0.25% |

| Webull UK | £1.71 | £12.51 | USD 0.50 | 0.35% |

| IG7 | £2.65 | £18.95 | USD 1.00 | 0.50% |

| Hargreaves Lansdown | US stock options trading is not available to UK residents | |||

| AJ Bell | ||||

| FreeTrade | ||||

| eToro UK | ||||

| Interactive Investor | ||||

| Robinhood UK | ||||

- DISCLAIMER: Comparison to other providers is based on our understanding of their published rates for trading US stock options available on their websites as of 23 August 2024. Some providers offer multi currency accounts which were not considered in the comparison. We assumed account base currency is GBP and that a FX conversion to USD is required. The comparison is shown for illustrative purposes only. For confirmation of the most up to date competitor rates on different account types and product information you should visit their websites.

- Total cost considers execution commission and FX conversion costs charged by the providers.

- The USD/GBP FX rate we used in the comparison table is 0.7581.

- IBKR, tiered options commissions of $0.65 per share. Minimum per order of $1.00. Assumed auto currency conversion charge of 3 bps (0.03%). Full rate card is available by visiting IBKR Commissions.

- Degiro fees effective August 23, 2024, per fee schedule on Degiro UK website. Assumed that the trade is placed via Auto FX Trader.

- Saxo's VIP account type used.

- IG does not charge any closing commission and commisisons are capped at 10 USD per leg for equity and etf options.

When you invest, your capital is at risk. The value of your portfolio can go down as well as up, and you may get back less than you invest.

Low Options Commissions

Options commissions range from

USD 0.15 to USD 0.65 per US options contract

View Options Commissions

Trade options globally on

30+ market centers.

View Market Centers

Professional Trading Platforms

Trading Platforms

Powerful, award-winning trading platforms* and tools available on desktop, mobile, and web. View market data, positions and trade multiple asset classes and products side-by-side on a single screen.

* For more info see our awards page.

Mobile Options Trading

Stay on top of your portfolio and the markets wherever you are. IBKR GlobalTrader, the IBKR Mobile app and the IMPACT app includes everything you need to trade and manage your options on-the-go.

Advanced Options Trading Tools

Write Options Tool

Rollover Options Tool

Generate extra income with the Write/Rollover Options tool. The Write tool scans your stock positions and calculates the number of covered options to write against your uncovered stock. Use the Rollover tool to roll over options that are about to expire to a similar option with a later expiration date.

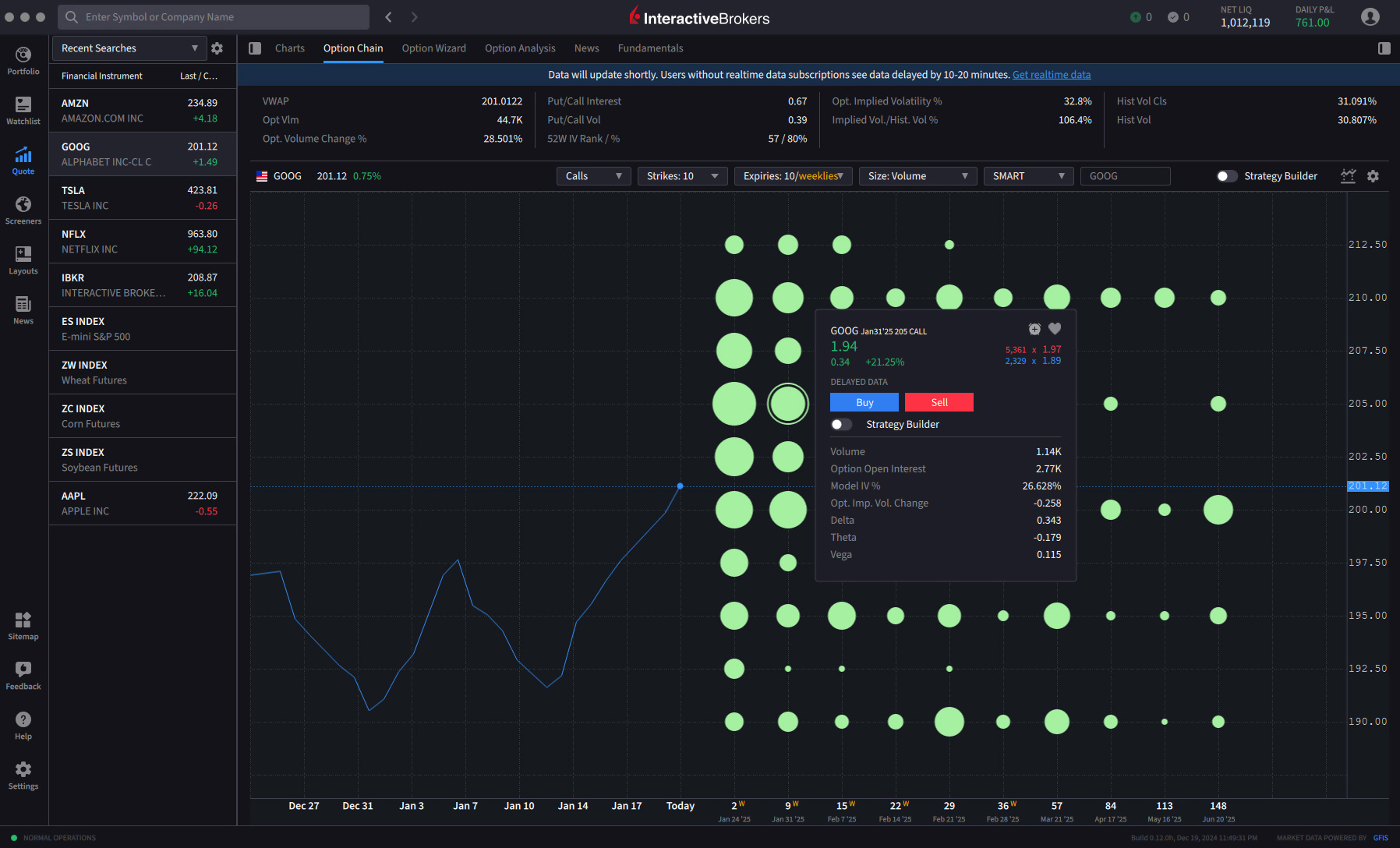

OptionTrader

OptionTrader displays market data for the underlying, allows you to create and manage options orders including combination orders, and provides the most complete view of available option chains, all in a single screen.

Options Analytics

Manipulate key option pricing criteria – including price, time and implied volatility – and visualize the impact on premiums.

Options Portfolio

Options Portfolio continuously and efficiently scours market data for low-cost option strategies to bring a portfolio in line with user-defined objectives for the Greek risk dimensions (Delta, Gamma, Theta and Vega).

Options Lattice

Traders using IBKR Desktop have access to Options Lattice, which depicts the 30-day price history for a stock alongside an array of bubbles measuring relative volume or value for key metrics across expirations and strike prices and compare bubble sizes for calls or puts indicating option volume, open interest or implied volatility.

Options Strategy Builder

Create multi-legged combination orders on the fly, and access predefined combinations (such as straddles, strangles, butterflies and condors). Point to the first desired strike and the tool will adjust to select the remaining legs.

Options Strategy Lab

Generate potentially profitable stock and option combinations, based on your forecast for stock and ETF prices, market volatility and other market variables.

Probability Lab

Redefine the price and volatility outlook for an underlying stock or ETF, and identify potentially profitable options strategies, based on that view.

Volatility Lab

Gain a snapshot of past and future readings for volatility on a stock and its industry peers then compare and contrast the option market’s view on the volatility of a stock over the coming months.

Options Trading Permissions

Clients can choose from four levels of options trading permissions to find choices more precisely aligned with their options trading strategies.

| Options Trading Permission Level | Summary |

| Level 1 | Covered calls are allowed. |

| Level 2 | Everything in Level 1, plus covered options positions such as long calls/puts, long straddles/strangles and protective calls/puts. |

| Level 3 | Everything in Levels 1 and 2, plus options strategies that have limited maximum potential loss such as short puts and short, long or unbalanced butterflies. |

| Level 4 | All options strategies are allowed. |

Award Winning Options Broker

Best for professional

options traders

Best for Global Options Traders

Best options trading

platforms and brokers

Best Options Trading

Brokers and Platforms

Best for Advanced

Options Traders