Volatility Orders

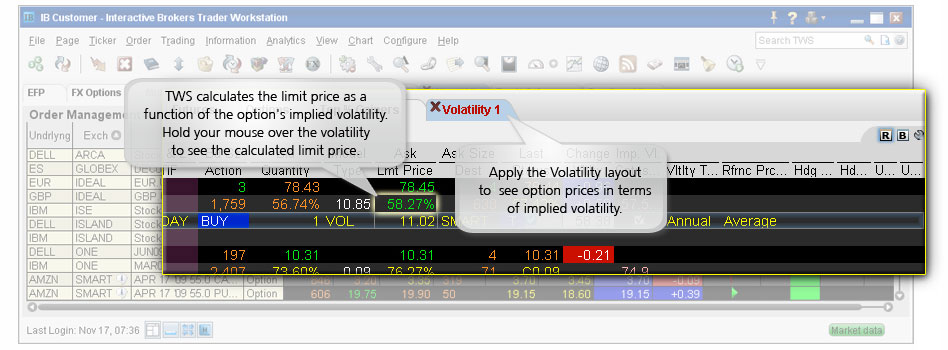

Specific to US options, investors are able to create and enter Volatility-type orders for options and combinations rather than price orders. Option traders may wish to trade and position for movements in the price of the option determined by its implied volatility. Because implied volatility is a key determinant of the premium on an option, traders position in specific contract months in an effort to take advantage of perceived changes in implied volatility arising before, during or after earnings or when company specific or broad market volatility is predicted to change. In order to create a Volatility order, clients must first create a Volatility Trader page from the Trading Tools menu and as they enter option contracts, premiums will display in percentage terms rather than premium. The buy/sell process is the same as for regular orders priced in premium terms except that the client can limit the volatility level they are willing to pay or receive.

Combination orders that meet the following criteria can be submitted as VOL orders:

- Smart-routed.

- All legs on the same underlying.

- Each leg must be independently eligible to use the VOL order type. For example, a BuyWrite order could not be sent as a VOL order since its stock leg would not allow this order type.

- All VOL orders must be DAY orders.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| FOPs | US Products | Smart | Attribute | ||||

| Options | Non-US Products | Directed | Order Type | ||||

| Combination Orders | Time in Force | ||||||

| View Supported Exchanges|Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

Example

You want to purchase one APR09 XYZ 85.0 call option based on volatility instead of bid/ask prices. To do this, you create a Volatility page in TWS to see bid/ask volatility as calculated by our Model Navigator. To create your Volatility page, select Volatility Trader from the Trading Tools menu. Next, create market data lines on the Volatility page for the APR09 XYZ 85.0 call option, then click the Ask price to create a BUY order. The Order Volatility field becomes editable and you enter a volatility value. The value you enter is used in the calculation to determine the limit price of the option. Finally, you submit your order.