Scale Orders

The ScaleTrader tool helps to ensure that larger sized trades, including combinations, are not subject to increasingly deteriorating prices. Consider the alternatives. You could submit a basic block order, and watch as acceptable prices at the start of execution rapidly give way to deteriorating prices as the market moves. Or, you could split up your order manually, and submit multiple, smaller orders at various price levels to minimize your footprint, but this requires time, effort and constant monitoring. ScaleTrader uses price and size determinants that you specify to automatically scale your large volume order into smaller, incrementally-priced components, and submits them as limit orders.

In addition, you can set a "scale offset" amount that ScaleTrader uses to submit opposite-side profit taking orders against your original order components. This allows position traders to pre-define the minimum amount of profitability acceptable for exiting a position. You can track the progress of the trade from the Scale Progress window, accessible from the right-click menu on a scale order line.

If prices move and a component of the order becomes unmarketable, the entire order waits until the component price becomes marketable. You CANNOT modify any component of the order. You may use the Good-Till-Cancelled time in force to allow the order to continue working through an unmarketable component. You may also elect to Restart the scale series if the order is cancelled, and Restore the filled profit order quantity to the original scale order.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Bonds | US Products | Smart | Attribute | ||||

| CFDs | Non-US Products | Directed | Order Type | ||||

| Forex | Time in Force | ||||||

| Futures | Algo | ||||||

| FOPs | |||||||

| Options | |||||||

| Stocks | |||||||

| Warrants | |||||||

| View Supported Exchanges|Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.

Scale Order Short Video

Your capital is at risk.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority.

Example

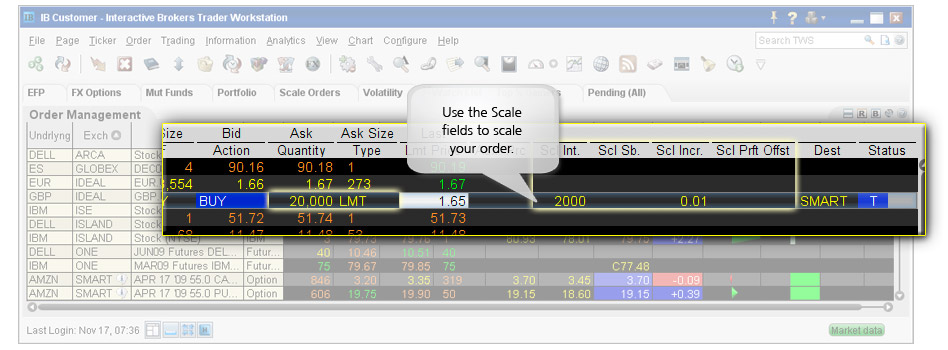

For a buy, the first component of 2,000 shares is submitted as a limit at $1.67, which is your starting price. After this level executes, the next limit order is submitted at $1.66, and so on. The order progress depends on the linear execution of each scaled component.

If instead of a buy example you are selling, the first 2,000 shares are submitted as a sell limit at $1.67, which is your starting price. After this level executes, the next level order is submitted at $1.68, and so on.

| NBBO: | $1.66 - $1.68 |

| Total Order Size: | 20,000 Shares |

| Scale Component Size: | 2,000 |

| Price Increment: | .01 |

| Initial Price: | $1.67 |

| Time in Force: | GTC |