Good-Til-Canceled (GTC) Orders

An order that uses the Good-Til-Canceled (GTC) time in force will continue to work until the order fills or is canceled 1. The ability to enter a bid well below the prevailing trading price for most asset classes, or an offer higher than its current level, allows an investor to place a resting order for days, weeks or months in advance without having to repeat the process each day. The GTC order type allows traders to pinpoint in advance levels at which they would like to enter or exit the market. GTC orders will generally 2 be canceled automatically under the following conditions:

- If a corporate action on a security results in a stock split (forward or reverse), exchange for shares, or distribution of shares.

- If the company issues a dividend where the rate exceeds 3% of the prior day's closing price or if the dividend is an extra/special dividend, regardless of the payment amount.

- If you do not log into your IB account for 90 days.

- At the end of the calendar quarter following the current quarter. For example, an order placed during the third quarter of 2011 will be canceled at the end of the fourth quarter of 2011. If the last day is a non-trading day, the cancellation will occur at the close of the final trading day of that quarter. For example, if the last day of the quarter is Sunday, the orders will be cancelled on the preceding Friday.

- Orders that are modified will be assigned a new "Auto Expire" date consistent with the end of the calendar quarter following the current quarter.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Bonds | US Products | Smart | Attribute | ||||

| CFDs | Non-US Products | Directed | Order Type | ||||

| EFPs | Time in Force | ||||||

| Forex | |||||||

| Futures | |||||||

| FOPs | |||||||

| Options | |||||||

| Stocks | |||||||

| Warrants | |||||||

| View Supported Exchanges|Open Users' Guide | |||||||

GTC Order Type Using Mosaic Short Video

Your capital is at risk.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority.

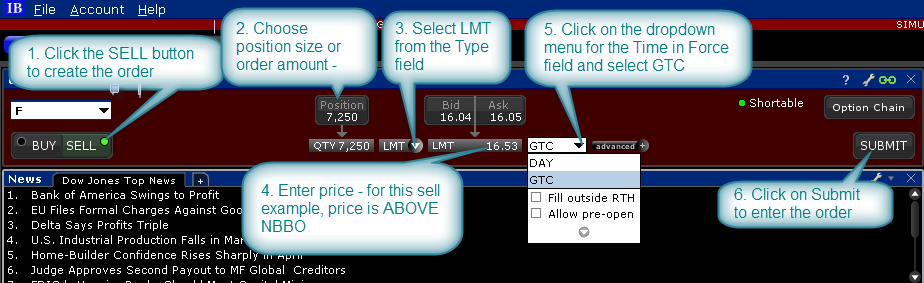

Mosaic Example

Order type In Depth – Good-Til-Canceled Order

In this example, we have an existing long position of 7,250 shares in Ticker symbol F, whose shares are quoted at 16.04/05. The investor wishes to leave a Limit order to sell the entire position at a price higher than the prevailing trading price of the stock. By modifying with a good-til-canceled attribute the investor can leave a resting order in the market in the hope his order will ultimately fill at his pre-determined level.

The advantage is that the investor does not have to place the same order day after day until his price level is achieved.

| Assumptions | |

|---|---|

| Action | SELL |

| Qty | 7,250 |

| Order Type | LMT |

| Market Price | 16.05 |

| Limit Price | 16.53 |

| Time in Force | GTC |

Chart – Entering a good-till-cancelled order on ticker symbol F

Click on the Sell button to generate an order ticket to sell shares in Ticker F. Note that the background turns red to denote an order to sell is in process. By Contrast, clicking on the Buy button would create the appearance of a blue background. When clicking on a ticker in your Portfolio window or from another linked window, the security will automatically load in the Order Entry panel. The Quantity field display will show the default value for the share amount but can be changed by clicking on the value field and selecting from the pop-up display. Alternatively users can type the required amount into the field. Enter the number of shares to be sold, or alternatively click on the Position button to sell the entire number of F shares in your portfolio. By clicking this button the Quantity field will adopt the entire position to sell. Next, from the Time-in-Force input field button select LMT as we want to enter a limit price to sell shares.

Click on the Price entry input field to change the limit price. In this example the price entered of $16.53 is significantly higher than the NBBO and above the daily trading range. In other words, it is unlikely to fill during the current session.

From the Time-in-Force selection box, choose GTC to ensure the order remains in force until filled. Note also that there are options to make the order active outside of regular trading hours (RTH) and allow it to fill in the pre-open session, which can be enabled by placing a check in the appropriate box. The GTC order to offer 7,250 shares at $16.53 each in Ticker F when reached is now ready to place. Click on the Submit button to transmit the trade, which will remain in place unless filled or cancelled by the user.

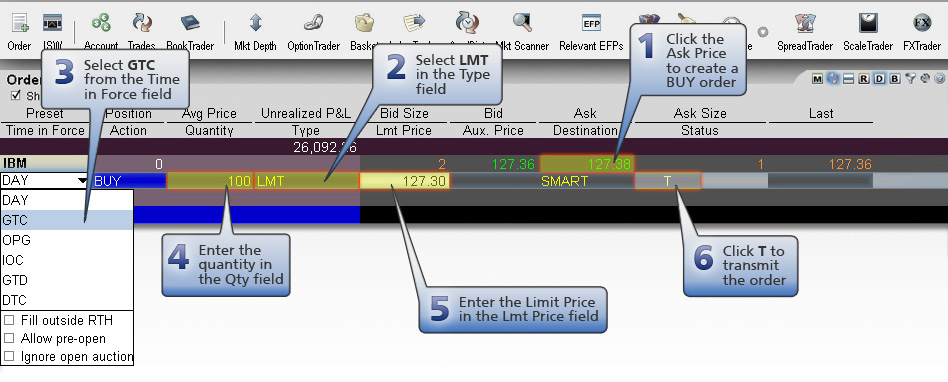

TWS Example

Order Type In Depth - Good-Til-Canceled Order

Step 1 – Enter a Good-Til-Canceled Limit Order

An order with a good-til-canceled (GTC) time in force keeps the order working until it executes or you cancel it. In this example, it is Monday, June 1 and you want to buy 100 shares of XYZ, which is currently at 127.38 and you want the order to keep working until it fills. You create a limit order for 100 shares with a Limit Price of 127.30 and select GTC as the Time in Force.

Step 2 – Order Transmitted

You've transmitted your limit order, which will work as a live order until it fills or until you cancel it.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 127.38 |

| Limit Price | 127.30 |

| Time in Force | GTC |

Step 3 – Order Will Work Until You Cancel It

Two days have passed. Shares of XYZ have fallen to 127.35 but not to your limit price of 127.30; your order for 100 shares of XYZ has not been filled. At this point, you decide that you no longer want to wait for the market price of XYZ to fall to your limit price, so you cancel the order instead of waiting for it to execute.

| Assumptions | |

|---|---|

| Action | BUY |

| Qty | 100 |

| Order Type | LMT |

| Market Price | 127.35 |

| Limit Price | 127.30 |

| Time in Force | GTC |

Disclosure

- Orders submitted to IB that remain in force for more than one day will not be reduced for ordinary dividends. For order adjustment considerations prior to the ex-dividend date, consider using a Good-Til-Date/Time (GTD) or Good-after-Time/Date (GAT) order type, or a combination of the two.

- Stock orders with a time in force attribute set to work beyond one trading session will be flagged as Do Not Reduce (DNR). IB will, on a best efforts basis, cancel such GTC orders as described above; however under certain circumstances IB may not be able to cancel such orders on a timely basis, including but not limited to when IB receives information on a corporate action within 48 hours of the announced effective date, and such GTC orders may continue to remain in force and may be eligible for execution. It is the Customer's responsibility to monitor their account and to act accordingly in the event that a corporate action has been announced.