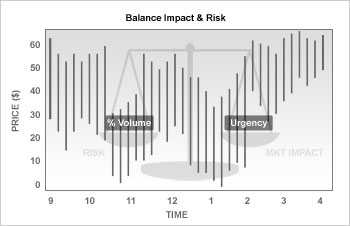

Balance Impact and Risk Algo

Objective

To balance the market impact of trading the option with the risk of price change over the time horizon of the order. This strategy considers the user-assigned level of risk aversion to define the pace of the execution, along with the user-defined target percent of volume.

User Inputs

- Max Percentage of Average Daily Volume

- Urgency/Risk Aversion Level

- Get Done

- Aggressive

- Neutral

- Passive

- Attempt Completion by EOD checkbox

Important Points

- The max percent you define is the percent of the total daily options volume for the entire options market in the underlying.

- The level of trade urgency determines the pace at which the order is submitted over the day.

- A higher urgency executes the order more quickly, opening it to greater market impact; a lower urgency allows the order to fill over time and incur less market impact.

- Note that the algo uses a randomization feature to keep the algo hidden, and by default always attempts to execute quickly. The Urgency/Risk Aversion selections are driven by the size of the order; it is designed for orders that will impact a high percent of the Average Daily Volume and its mechanism may be insignificant for smaller orders.

- If Attempt Completion by End of Day is checked, we will try to complete the order today. Please note that we may leave a portion of the order unexecuted if the risk of the price changing overnight is less than the extra cost of executing the whole order today.

- Available for US Equity and Index Options.

| Products | Availability | Routing | TWS | ||||

|---|---|---|---|---|---|---|---|

| Options | US Products | Smart | Attribute | ||||

| Non-US Products | Directed | Order Type | |||||

| IB Algo | Time in Force | ||||||

| IB Algo | |||||||

| Open Users' Guide | |||||||

Notes:

The Reference Table to the upper right provides a general summary of the order type characteristics. The checked features are applicable in some combination, but do not necessarily work in conjunction with all other checked features. For example, if Options and Stocks, US and Non-US, and Smart and Directed are all checked, it does not follow that all US and Non-US Smart and direct-routed stocks support the order type. It may be the case that only Smart-routed US Stocks, direct-routed Non-US stocks and Smart-routed US Options are supported.