Pre-Trade Allocations

Pre-Trade Allocations

Allocate block trades to multiple client

accounts with a single click.

Professional Advisors and Investment Managers use Pre-Trade Allocations to:

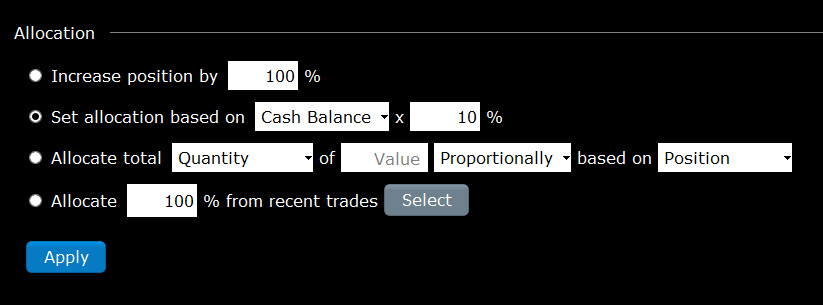

- Define a variety of criteria to automatically allocate shares to a single client account or to multiple client accounts.

- Set up Account Groups to allocate shares based on a single method for a group of accounts.

- Modify allocations on an order-by-order basis.

- Set a default allocation that will be used automatically when you create an order, and easily change the default allocation at any time.

- Create Account Aliases to assign easy-to-remember names to accounts.

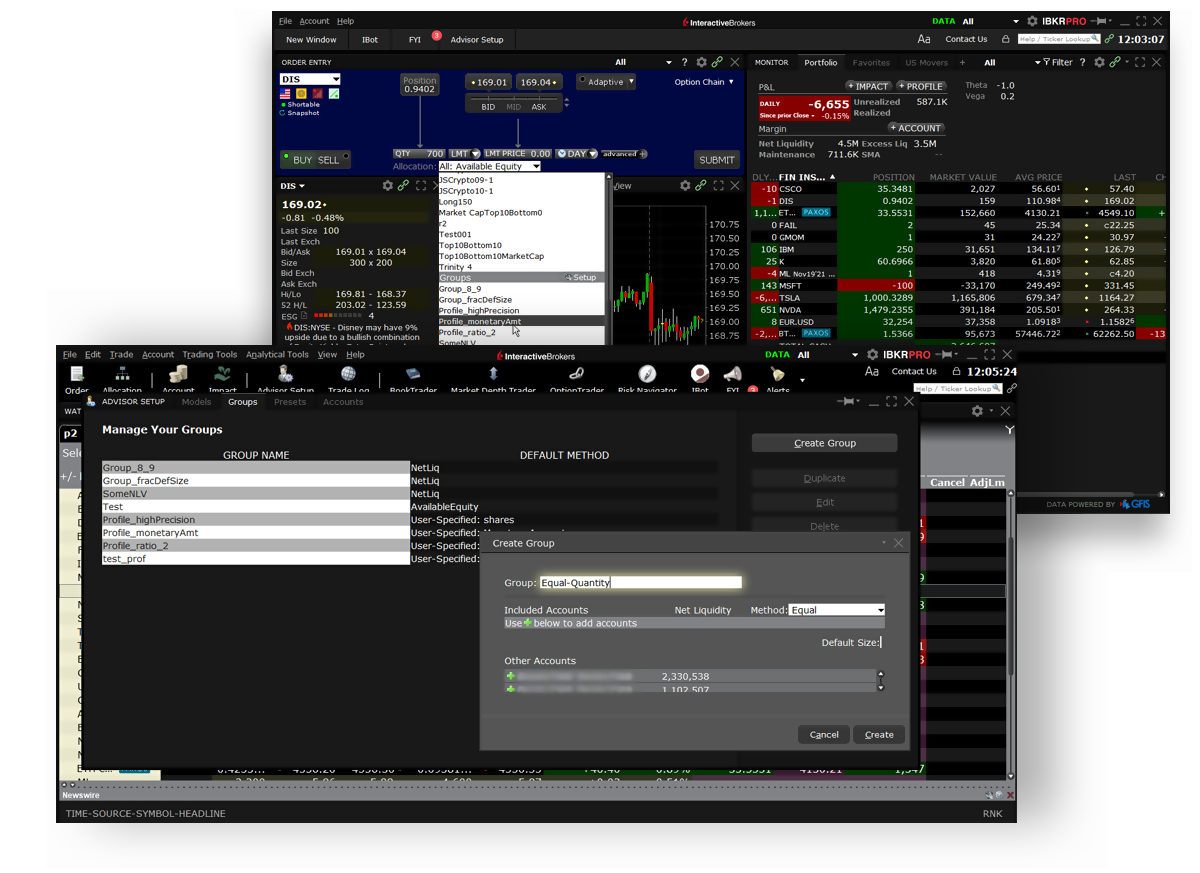

- Place orders and allocate shares directly from Trader Workstation.

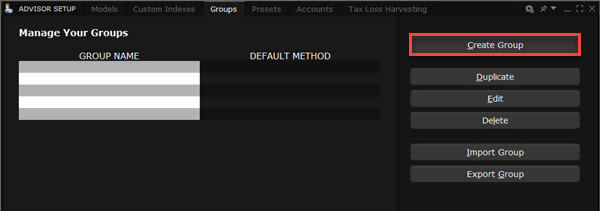

Account Groups

Automatically calculate ratios and allocate shares to pre-defined group of accounts. Supported allocation methods include:

- Net Liquidation - Allocate shares based on ratios derived from each account's Net Liquidation Value.

- Available Equity - Allocate shares based on ratios derived from each account's Available Equity.

- Equal - Allocate shares equally to all accounts in the group.

- User-Specified - Create methods with user-defined values such as number of units, per account ratios or percentages, and per-account monetary amounts.

Find out more about Account Groups and Methods in the TWS Users' Guide

Allocation Order Tool

Manage allocations more efficiently and easily allocate orders to:

- Reduce or exit an existing position

- Increase or open a new position

- Rotate positions (close some and open others, almost simultaneously)

The Allocation Order Tool also includes IBKR's Tax Loss Harvesting, which helps advisors optimize any tax benefits from capital losses and distribute the losses across affected accounts.

Find out more about the Allocation Order Tool

Rebalance for Advisors

Advisors can choose to redistribute percentages of positions in their sub portfolio(s) by using the TWS Rebalance feature. Rebalance ALL accounts, a single subaccount, or a user-defined Account Group, which includes a subset of accounts. TWS opens and closes positions to rebalance selected accounts' portfolios based on the new percentages you enter. You can add financial instruments and create orders just as you would from the main trading screen.

Account Aliases

Account Aliases assigned to client accounts let you easily identify the accounts by meaningful names rather than account numbers.